Invoices

Our company uses Ariba for creating and sending Purchase Orders in all markets. However, the invoicing process has some variation based on the market.

Please follow the invoicing guidance below based on the ‘Bill to’ market on the Purchase Order (PO)

NEW for SINGAPORE – All suppliers in Singapore are required to have a legal profile setup in the SAP Business Network. Please follow these instructions to create your legal profile if you haven’t done so already. KB0401301 – How do I set up my GST for Singaporean invoicing in Ariba?

| Bill to Markets | Invoicing Process |

|---|---|

| All Markets except the ones shown below that are P2P Paper and P2O | P2P & P2P Proforma |

| China, India, Indonesia, Philippines — Greece, Hungary, Israel, Romania | P2P Paper |

| China (if registered to issue E-Invoices: P2P Proforma) | P2P Proforma & Paper |

| Algeria, Argentina, Bosnia and Herzegovina, Brazil, Chile, Egypt, Italy, Jordan, Lebanon, Morocco, Serbia, Turkey | P2O |

| Germany (for businesses with DE VAT ID and DE business address) | P2P or Germany E-Invoice |

| Poland, Croatia, Belgium | E-Invoicing |

- In this fully automated Procure-to-Pay (P2P) process, our suppliers must submit invoices directly via the SAP Business Network.

- The invoices will reconcile in Ariba and will then post for payment.

- Suppliers have full visibility into the status of their invoices (including payment status).

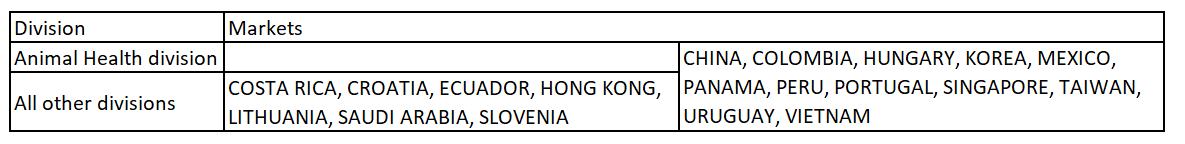

- In the following markets, a Pro-Forma* invoice (legal copy) must also be attached (uploaded) in Ariba

- In some cases, suppliers may also be required to attach supporting documentation in Ariba to ensure the PO requester fully understands the details of what is being invoiced.

- The invoices will reconcile in Ariba and will then post for payment.

- Suppliers will have full visibility into the status of their invoices (including payment status).

FAQs

Invoice submittal instructions differ based on the supplier’s Ariba account.

For suppliers with a registered Standard Account, they should access the interactive email and submit the invoice following the steps from the “process order” button. Here is a helpful FAQ that suppliers can access directly. How do I process an order in my SAP Business Network Standard account?

For suppliers with a registered Enterprise Account, they should log into their SAP Business Network account and submit a PO-based invoice.

Detailed Instructions

How to Submit an Invoice on the SAP Business Network

* Proforma definition – The Pro-Forma markets require the Vendors to attach the legal copy of the original invoice, which will need to be validated by the invoice processing team as per the country’s legal regulations.

- In this semi automated Procure-to-Pay process (P2P Paper) , our suppliers must submit invoices outside of the Ariba Network.

- Invoices should be emailed as an attached document to our service center.

- Received invoices are then manually posted by our company’s invoice processing team into our Ariba system.

- Following manual posting, the invoice will then reconcile and post for payment.

- Suppliers will have full visibility into the status of their invoices (including payment status).

FAQs

How do I check the payment status of an invoice in Ariba?

Detailed Instructions

All invoice copies must be submitted to the Invoice Processing Team via email or postal system.

Email for invoice reception: EMEA

| Market | MSD Division | Email address |

|---|---|---|

| Greece | Animal Health | Email: Invoiceah.emea@msd.com |

| Greece | Human Health | Email: Invoicehh.emea@msd.com |

| Romania | Animal Health | For Intervet Romania (1539): intervet_inv@msd.com with cc to Miriam Romanu and Catalin Paraschiv |

| Romania | Human Health | For MSD Romania (1213): msdro_invoices@msd.com with cc to Aura Dragomir, Catalin Paraschiv and Cristina Jilavu |

| Hungary | Animal Health | e-szamla@msd.com or to 1095 Budapest, Lechner Ödön fasor 10/B |

| Hungary | Human Health | e-szamla@msd.com or to 1095 Budapest, Lechner Ödön fasor 10/B |

| Israel | Animal Health | Soft Copies: scrinvoices@msd.com Hard Copies: 18 Hamelacha St. Netanya, 4250553 Israel |

| Israel | Human Health | Soft Copies: invoiceisrael@msd.com Hard Copies : 34 Hacharash St. Hod Hasharon 4527701 Israel |

Email for invoice reception: JCAP

| Market | MSD Division | email address |

|---|---|---|

| China | Human Health | Send via post only: Receiver name : MSD Vendor invoice Team Genpact (Dalian) Sdn Bhd Building 21, No.30 Software Park Road(E), Shahekou District, Dalian, Liaoning, 116023 8F MSD Team |

| China | Animal Health | Send via post only: Receiver name : MSD Vendor invoice Team Genpact (Dalian) Sdn Bhd Building 21, No.30 Software Park Road(E), Shahekou District, Dalian, Liaoning, 116023 8F MSD Team |

| India | Human Health | BSCAPJ.STS.Invoice@msd.com |

| India | Animal Health | msdahin@msd.com |

| Indonesia | Human Health | msdid_hh_ap_inv@msd.com |

| Indonesia | Animal Health | MSDAHID@msd.com |

| Philippines | Human Health | msdph_hh_ap_inv@msd.com |

| Philippines | Animal Health | msdahph@msd.com |

- In this semi automated Procure-to-Pay process (P2O) , our suppliers must submit invoices outside of the Ariba Network.

- Invoices should be emailed as an attached document to our service center.

- Received invoices are then manually posted by our company’s invoice processing team into our company’s SAP Enterprise Resource Planning (ERP) system.

- Following manual posting, the invoice will then reconcile and post for payment.

- Suppliers will NOT HAVE visibility into the status of their invoices (including payment status).

FAQs

Q: How do I check the payment status of an invoice?

A: Contact the MSD Business Service Center (see Support Contact Details tab)

Email for invoice reception: Americas

| Market or Region | MSD Division | Email Address |

|---|---|---|

| Argentina | Human Health | facturas.argentina@msd.com |

| Argentina | Animal Health | facturas.argentina@msd.com |

| Brazil | Human Health | recebimento@msd.com |

| Brazil | Animal Health | recebimentoah@msd.com |

| Chile | Human Health | chile_contabilidad@msd.com |

| Chile | Animal Health | ahchile_contabilidad@msd.com |

Email for invoice reception: EMEA

| Market | MSD Division | Email or postal address |

|---|---|---|

| Algeria | Animal Health | Invoiceah.emea@msd.com |

| Bosnia and Herzegovina | Human Health | Email: Not Applicable Physical address: Tešanjska 24a, Sarajevo |

| Egypt | Animal Health | 67 Teseen St, 5th Settlement, Cairo, 11825 |

| Egypt | Human Health | 67 Teseen St, 5th Settlement, Cairo, 11825 |

| Italy | Animal Health | Italian Suppliers : Italian tax Authority(SDI) Foreign Supplier: Invoiceah.emea@msd.com or Invoicehh.emea@msd.com |

| Italy | Human Health | Italian Suppliers : Italian tax Authority(SDI) Foreign Supplier: Invoiceah.emea@msd.com or Invoicehh.emea@msd.com |

| Jordan | Human Health | Emmar Tower, Block C, Amman, Jordan |

| Lebanon | Human Health | Qubic Square Center, 11th floor, sin el fil, Beirut |

| Morocco | Animal Health | 166-168 BD ZERKTOUNI CASABLANCA |

| Morocco | Human Health | 166-168 BD ZERKTOUNI CASABLANCA |

| Serbia | Human Health | Link for electronic system : https://efaktura.mfin.gov.rs/login Hard Copies: physical address : Omladinskih brigada 90a/1400 Email: msd-serbia@msd.com |

| Turkey | Animal Health | IDEA (service provider) portal- https://login.visionplus.com.tr/Login/Account/Login/56cc4d7a-adb6-4fc0-aa98-dfb4011745a3 |

| Turkey | Human Health | IDEA (service provider) portal- https://login.visionplus.com.tr/Login/Account/Login/56cc4d7a-adb6-4fc0-aa98-dfb4011745a3 |

‒Suppliers have the option to submit only German E-invoices via email (outside of the Ariba Network). If not adopting German E-invoices yet, suppliers are expected to continue submitting invoices via Ariba Network.

‒E-invoices should be emailed to e.invoicing@msd.com as an attached document in the compliant E-invoicing formats (e.g. XRechnung, ZUGFeRD) required by German authorities.

‒E-invoices must safeguard sensitive information and conform to EN 16931 (EU) Global Standards.

‒Electronic invoices are archived securely by MSD and must be retrievable for a minimum of 10 years, in accordance with German tax laws.

‒Received E-invoices are then validated and processed within 3 business days by Accounts Payable team.

‒Following processing, the invoice will then be scheduled for payment according to Purchase Order payment terms.

‒Suppliers will have visibility into the status of their PO invoices (including payment details). Invoices submitted as Non-PO payment will not be visible in Ariba.

FAQs

Invoice submittal instructions differ based on the supplier’s Ariba account.

For suppliers with a registered Standard Account, they should access the interactive email and submit the invoice following the steps from the “process order” button. Here is a helpful FAQ that suppliers can access directly. How do I process an order in my SAP Business Network Standard account?

For suppliers with a registered Enterprise Account, they should log into their SAP Business Network account and submit a PO-based invoice.

Detailed Instructions

How to Submit an Invoice on the SAP Business Network

* Proforma definition – The Pro-Forma markets require the Vendors to attach the legal copy of the original invoice, which will need to be validated by the invoice processing team as per the country’s legal regulations.

Important Information About eInvoicing in Poland

The content below is sourced from the European Commission website and is provided for your convenience. MSD does not create, verify, or maintain this information. For the most accurate and up-to-date details, please refer directly to the official European Commission website.

- Updated Timeline

- Voluntary Krajowy System e-Faktur (KSeF): In use since January 2022.

- 1 July 2026: Mandatory KSeF for all active VAT taxpayers for B2B transactions.

- 1 January 2027: Mandatory KSeF for taxpayers exempt from VAT.

- 1 January 2027: Penalties for non-compliance will come into effect.

- Core Rules

- Scope: Mandatory for all domestic B2B invoices issued by taxpayers with a fixed establishment in Poland. B2C invoices remain outside the scope of mandatory KSeF.

- Process: Invoices must be issued and transmitted through the central KSeF platform. An invoice is considered legally issued only after it is successfully processed by KSeF and assigned a unique KSeF ID number.

- Credit/Corrective Notes: Must reference the KSeF ID of the original invoice they are correcting.

- Technical & Legislative Developments

- Legislation: The amended law confirming the new timeline was finalized in September 2025.

- Schema & API: The final technical documentation for the KSeF 2.0 API and the FA(2) logical schema are published.

- Environments: Test Environment: Available since October 2025.

- Production Environment: Expected to be fully available for final integrations by January 2026.

- KSeF ID on Bank Transfers: The requirement to include the KSeF ID on bank transfer descriptions for invoice payments will be enforced from 1 January 2027.

- Offline Mode: A permanent “offline mode” is available for situations where a taxpayer cannot connect to KSeF. Invoices are issued with a special QR code and must be uploaded to KSeF within one working day. Attachments: The FA(2) schema allows for the inclusion of structured attachments to an invoice.

FAQs

How do I check the payment status of an invoice in Ariba?

Detailed Instructions

All invoice copies must be submitted to the Invoice Processing Team via email or postal system.

Email for invoice reception: EMEA

| Market | MSD Division | Email address |

|---|---|---|

| Greece | Animal Health | Email: Invoiceah.emea@msd.com |

| Greece | Human Health | Email: Invoicehh.emea@msd.com |

| Romania | Animal Health | For Intervet Romania (1539): intervet_inv@msd.com with cc to Miriam Romanu and Catalin Paraschiv |

| Romania | Human Health | For MSD Romania (1213): msdro_invoices@msd.com with cc to Aura Dragomir, Catalin Paraschiv and Cristina Jilavu |

| Hungary | Animal Health | e-szamla@msd.com or to 1095 Budapest, Lechner Ödön fasor 10/B |

| Hungary | Human Health | e-szamla@msd.com or to 1095 Budapest, Lechner Ödön fasor 10/B |

| Israel | Animal Health | Soft Copies: scrinvoices@msd.com Hard Copies: 18 Hamelacha St. Netanya, 4250553 Israel |

| Israel | Human Health | Soft Copies: invoiceisrael@msd.com Hard Copies : 34 Hacharash St. Hod Hasharon 4527701 Israel |

Email for invoice reception: JCAP

| Market | MSD Division | email address |

|---|---|---|

| China | Human Health | Send via post only: Receiver name : MSD Vendor invoice Team Genpact (Dalian) Sdn Bhd Building 21, No.30 Software Park Road(E), Shahekou District, Dalian, Liaoning, 116023 8F MSD Team |

| China | Animal Health | Send via post only: Receiver name : MSD Vendor invoice Team Genpact (Dalian) Sdn Bhd Building 21, No.30 Software Park Road(E), Shahekou District, Dalian, Liaoning, 116023 8F MSD Team |

| India | Human Health | BSCAPJ.STS.Invoice@msd.com |

| India | Animal Health | msdahin@msd.com |

| Indonesia | Human Health | msdid_hh_ap_inv@msd.com |

| Indonesia | Animal Health | MSDAHID@msd.com |

| Philippines | Human Health | msdph_hh_ap_inv@msd.com |

| Philippines | Animal Health | msdahph@msd.com |

Important Information About eInvoicing in Croatia

The content below is sourced from the European Commission website and is provided for your convenience. MSD does not create, verify, or maintain this information. For the most accurate and up-to-date details, please refer directly to the official European Commission

- What exists today

- In-store B2C clearance since 2013.

- B2G e-invoicing exchange since 2019.

- What’s coming

- 1 Sep 2025: Voluntary B2B e-invoicing + DRR.

- 1 Jan 2026 (decentralized CTC):

- Mandatory e-invoicing and DRR for all VAT taxpayers on B2B & B2G; issuers and recipients must report to the Fiscalization system.

- Non-VAT businesses must be able to receive e-invoices.

- Online B2C payments fall under reporting to Fiscalization.

- 1 Jan 2027: Non-VAT businesses must issue and report e-invoices for B2B transactions.

- Requirements (high level)

- No change to existing B2G and in-store B2C processes.

- All businesses must be registered in the local business directory.

- Buyers have 5 days to fulfill their DRR obligation.

- Operate via Service Provider (SP) and/or Accredited Service Provider (ASP); only ASP can communicate with Fiscalization 2.0.

- E-signature is required on the DRR layer, not for the e-invoice itself.

- E-invoices must be EN 16931 compliant; DRR uses XML.

- Archiving: 11 years.

- Transaction flow (DCTCE model)

- Supplier reports the e-invoice at issuance to Fiscalization and sends it via an SP to the buyer.

- Supplier gets a reporting confirmation.

- Buyer has 5 working days to report the received e-invoice to Fiscalization.

- Buyer receives confirmation of AP data reporting.

- If buyer rejects, the rejection and reason are reported to Fiscalization; buyer also informs the supplier outside the system.

- If not rejected, the supplier later submits payment info to the e-reporting service.

FAQs

Q: How do I check the payment status of an invoice?

A: Contact the MSD Business Service Center (see Support Contact Details tab)

Email for invoice reception: Americas

| Market or Region | MSD Division | Email Address |

|---|---|---|

| Argentina | Human Health | facturas.argentina@msd.com |

| Argentina | Animal Health | facturas.argentina@msd.com |

| Brazil | Human Health | recebimento@msd.com |

| Brazil | Animal Health | recebimentoah@msd.com |

| Chile | Human Health | chile_contabilidad@msd.com |

| Chile | Animal Health | ahchile_contabilidad@msd.com |

Email for invoice reception: EMEA

| Market | MSD Division | Email or postal address |

|---|---|---|

| Algeria | Animal Health | Invoiceah.emea@msd.com |

| Bosnia and Herzegovina | Human Health | Email: Not Applicable Physical address: Tešanjska 24a, Sarajevo |

| Egypt | Animal Health | 67 Teseen St, 5th Settlement, Cairo, 11825 |

| Egypt | Human Health | 67 Teseen St, 5th Settlement, Cairo, 11825 |

| Italy | Animal Health | Italian Suppliers : Italian tax Authority(SDI) Foreign Supplier: Invoiceah.emea@msd.com or Invoicehh.emea@msd.com |

| Italy | Human Health | Italian Suppliers : Italian tax Authority(SDI) Foreign Supplier: Invoiceah.emea@msd.com or Invoicehh.emea@msd.com |

| Jordan | Human Health | Emmar Tower, Block C, Amman, Jordan |

| Lebanon | Human Health | Qubic Square Center, 11th floor, sin el fil, Beirut |

| Morocco | Animal Health | 166-168 BD ZERKTOUNI CASABLANCA |

| Morocco | Human Health | 166-168 BD ZERKTOUNI CASABLANCA |

| Serbia | Human Health | Link for electronic system : https://efaktura.mfin.gov.rs/login Hard Copies: physical address : Omladinskih brigada 90a/1400 Email: msd-serbia@msd.com |

| Turkey | Animal Health | IDEA (service provider) portal- https://login.visionplus.com.tr/Login/Account/Login/56cc4d7a-adb6-4fc0-aa98-dfb4011745a3 |

| Turkey | Human Health | IDEA (service provider) portal- https://login.visionplus.com.tr/Login/Account/Login/56cc4d7a-adb6-4fc0-aa98-dfb4011745a3 |

Important Information About eInvoicing in Belgium

The content below is sourced from the European Commission website and is provided for your convenience. MSD does not create, verify, or maintain this information. For the most accurate and up-to-date details, please refer directly to the official European Commission website.

-

Mandate & scope

‒Start date: 1 January 2026.

‒Who: Belgian VAT-registered businesses for domestic B2B (fixed establishment in Belgium).

‒Excludes: B2C and VAT-exempt (Article 44) entities. -

Standards & transport

‒Format: Peppol BIS 3.0 for structured e-invoices. Deviations allowed if EN-16931/CEN-TS 16931 compliance is ensured.

‒Transmission: Peppol is the default network. -

Other impacts

‒B2G: Mercurius (on Peppol) remains the main channel.

‒2028: Near real-time reporting for transactions involving VAT-liable businesses and users of the GKS (cash register) system.

‒Automated data flows: cash registers, payment, and invoicing systems will connect to the tax administration.

‒Hermes platform: future uncertain/obsolescence expected as market players support taxpayers.

FAQs

Q: How do I check the payment status of an invoice?

A: Contact the MSD Business Service Center (see Support Contact Details tab)